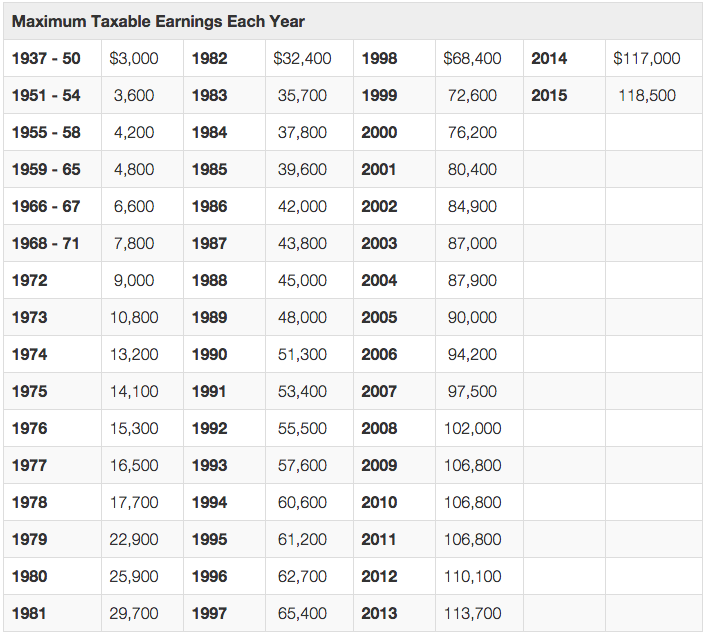

Social Security Tax Rate 2025 Limit - Social Security Tax Limit 2025 Withholding Tables Lenka Mariana, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. 2025 Federal Social Security Tax Limit Erena Jacenta, The social security wage cap will be increased from the 2025 limit of $160,200 to the new 2025 limit of $168,600.

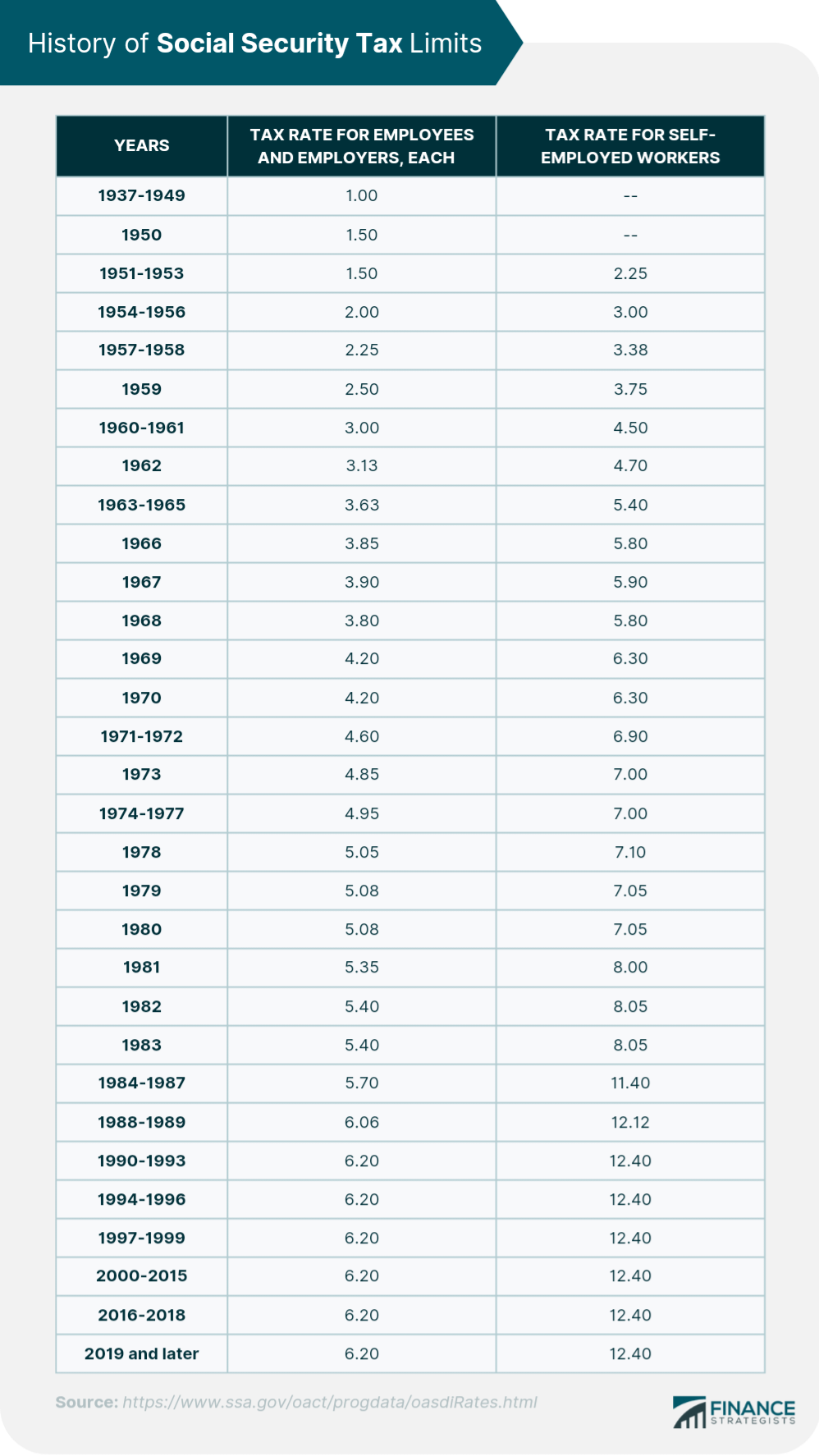

Social Security Tax Limit 2025 Withholding Tables Lenka Mariana, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each.

Social Security Tax Limit 2025 What is It and Everything You Need to, This is a significant jump from 2025’s taxable.

Social Security Tax Limit 2025 Withholding Chart Elsa Suzanne, The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Social Security Tax Limit 2025 Withholding Chart Mavra Sibella, To determine whether you are subject to irmaa charges,.

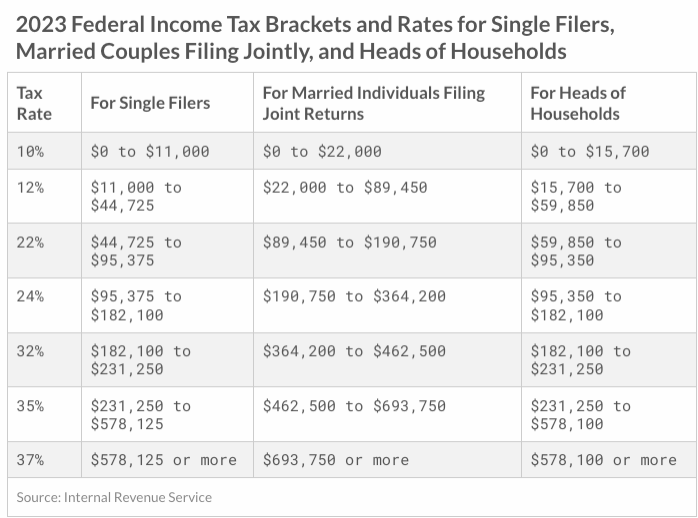

Standard deduction for salaried employees increased to rs 75,000. [3] there is an additional 0.9% surtax on top of the standard 1.45%.

Social Security Taxable Limit 2025 Astrix Adelina, The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2025 for leave taken after march 31, 2021, and.

Max Social Security Tax 2025 Withholding Table Reyna Clemmie, In 2025, the social security tax limit rises to $168,600.

Maximum Social Security Tax 2025 Withholding Table Cyndi Dorelle, What is the social security limit?

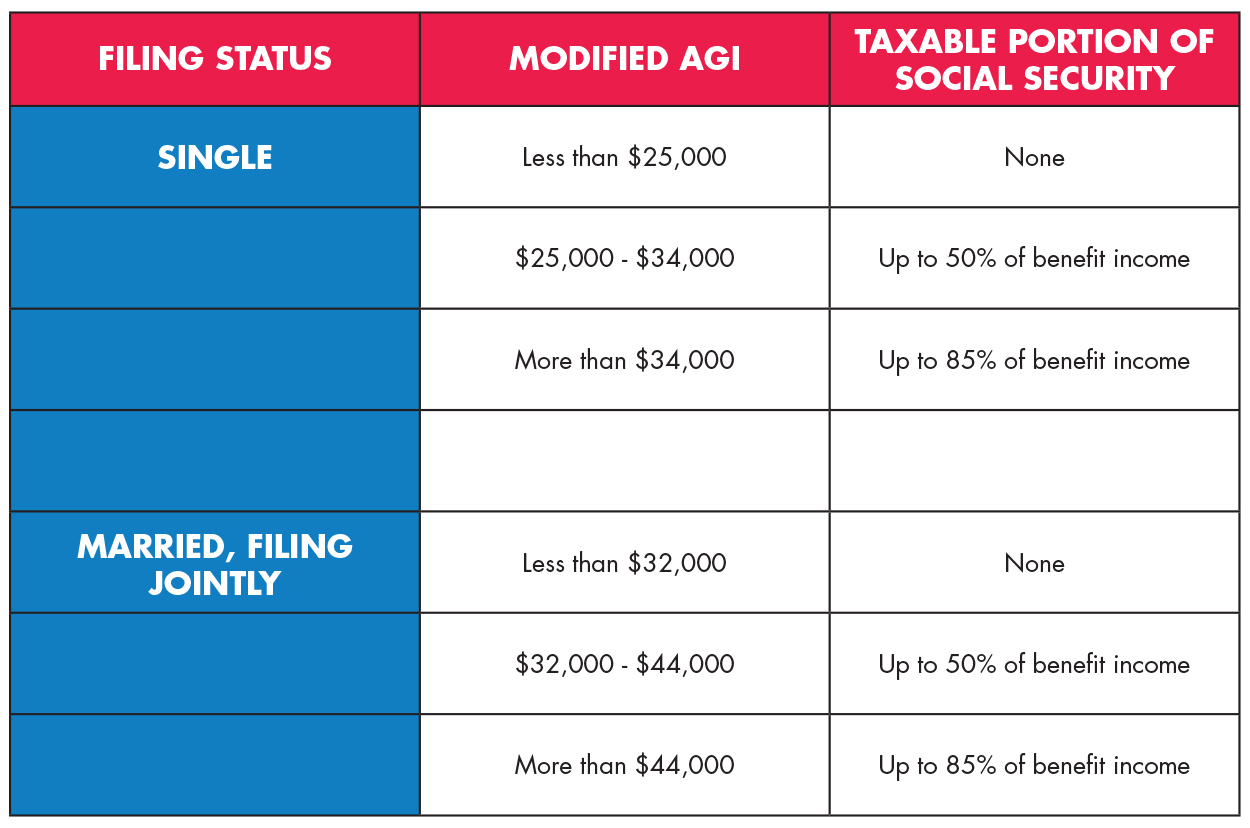

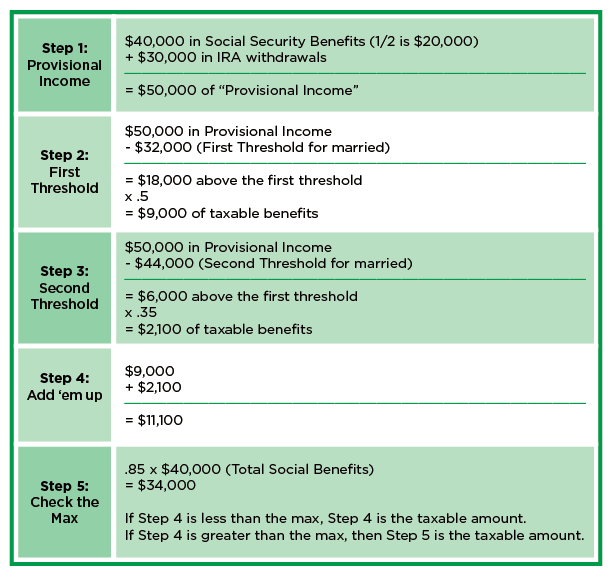

Social Security Tax Rate 2025 Limit. Workers earning less than this limit pay a 6.2% tax on their earnings. The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

Tax rates for the 2025 year of assessment Just One Lap, Standard deduction for salaried employees increased to rs 75,000.

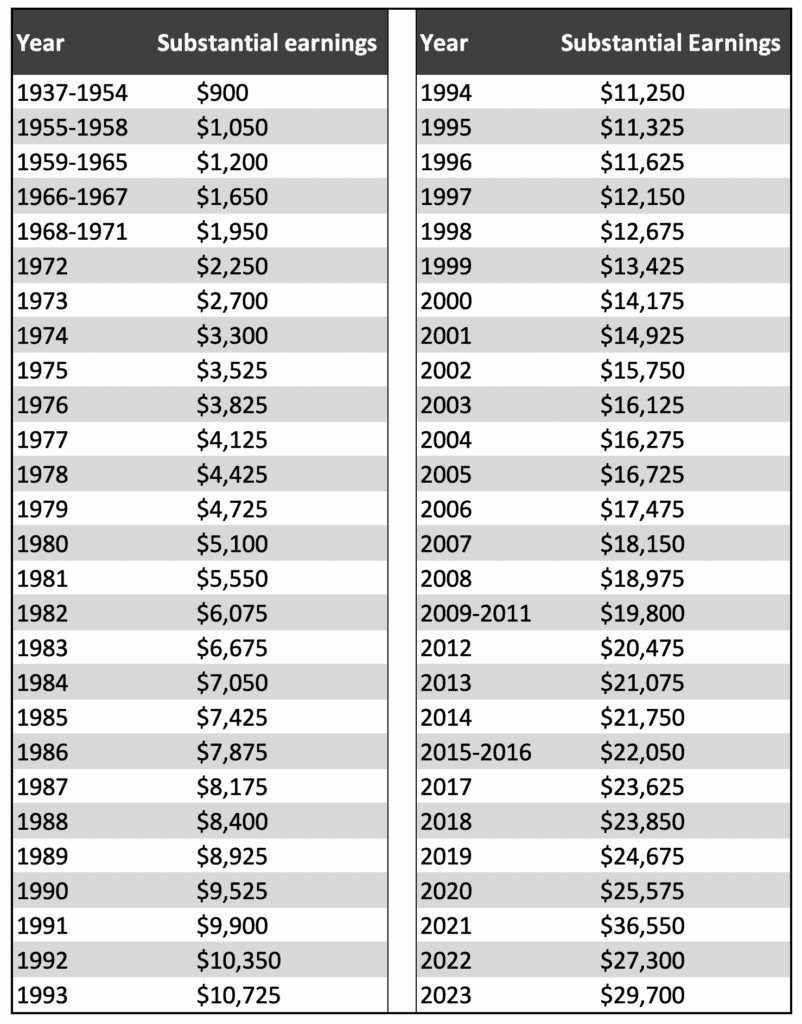

Social Security Tax Limits On 2025 Karie Marleen, The social security wage base is the maximum gross earnings subject to social security tax that can be imposed on an employee.